WeWork has introduced it's going to start accepting crypto payments The transfer is in partnership with BitPay and CoinbaseBitPAy will deal with the payments with WeWork accepting Bitcoin, Etheruem, USD Coin (USDC) and Paxos (PAX)WeWork will dangle the crypto paid for services and products on its steadiness sheetCoinbase becomes the first company to pay WeWork in crypto

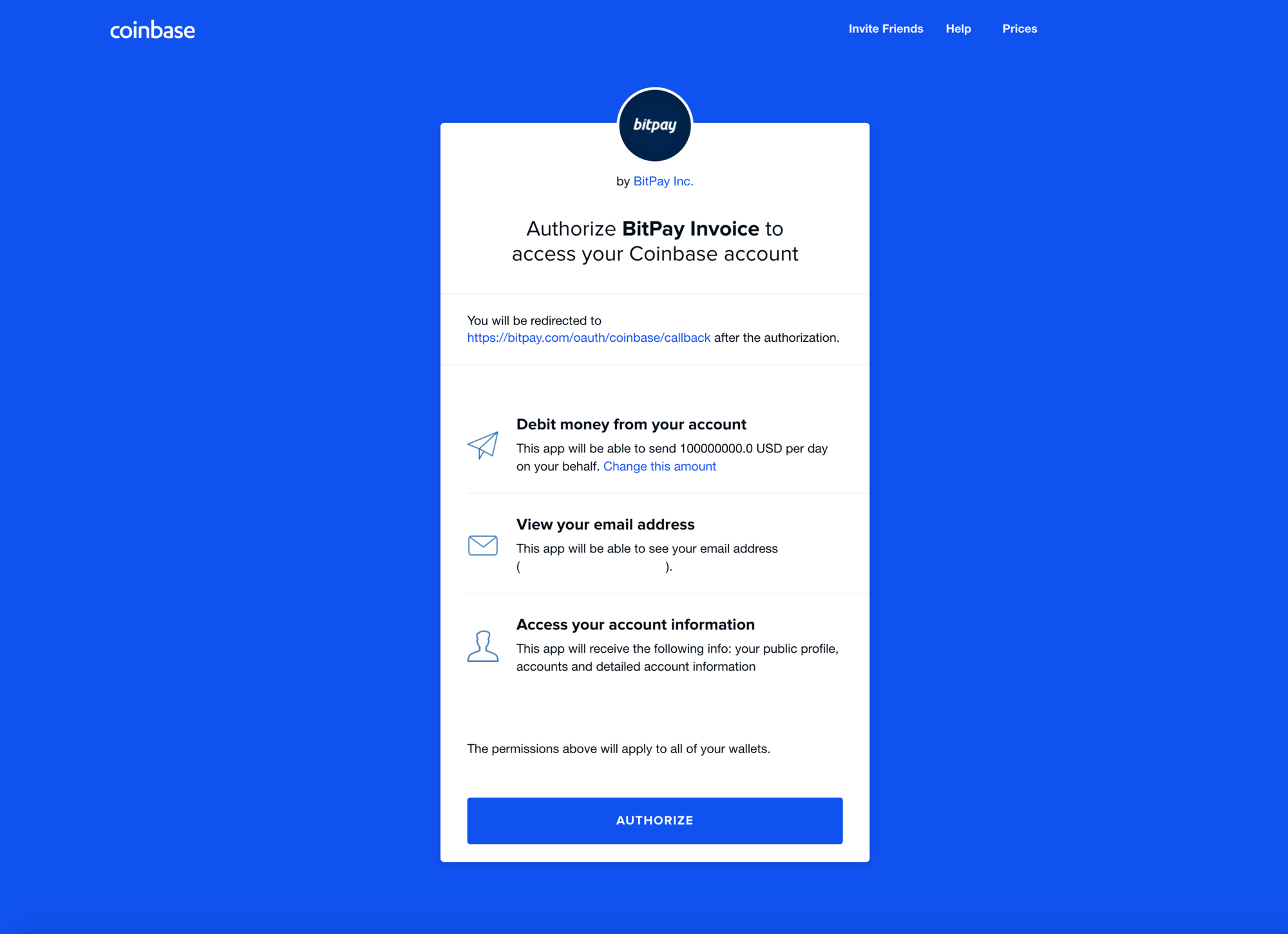

1 day ago WeWork, a U.S.-based flexible space provider, announced earlier this week is now accepting payment in select cryptocurrencies. The company is notably working with BitPay and Coinbase to utilize. Through BitPay, WeWork will be accepting Bitcoin (BTC), Ethereum (ETH), USD Coin (USDC), and Paxos (PAX). The crypto assets will be kept on the balance sheet. WeWork will be keeping the cryptocurrencies on its balance sheet, and will also pay third-party partners in crypto assets through Coinbase, which is a WeWork member. Want the convenience of a bitcoin exchange with the security of a bitcoin wallet? Now you can have both! We walk you through integrating your BitPay Wallet w. How to connect Coinbase and the BitPay App On the Home screen of the wallet, tap the Connect Account link in the middle of the screen. Next, sign into your Coinbase account by tapping Connect Coinbase Account. Enter the email address and password for your Coinbase account and tap SIGN IN.

The flexible running house company of WeWork has just introduced that it's going to begin accepting bills using select cryptocurrencies. The move via the company is in partnership with BitPay and Coinbase as WeWork embraces the flexibility of the use of cryptocurrencies for inbound and outbound transactions.

BitPay to function a Payment Processor with WeWork Keeping Crypto

Furthermore, BitPay will function the crypto fee merchant for WeWork. The latter company will accept Bitcoin (BTC), Ethereum (ETH), USD Coin (USDC), Paxos (PAX) and several other other virtual assets as cost options.WeWork also intends to hold virtual assets paid for its services and products, on its steadiness sheet.

The CEO of BitPay, Stephen Pair, additional highlighted the importance of WeWork accepting digital payments to further crypto adoption. Mr. Pair had this to say in regards to the milestone.

BitPay believes crypto is the longer term of fintech and payments and our objective is to seriously change how businesses and those send, receive, and store cash. WeWork is giving their customers an leading edge cost option that is cheaper and more straightforward than credit cards and taps a community worth over $2 trillion.

Coinbase to Change Into the first Company to Pay WeWork in Crypto

Additionally, WeWork will pay landlords and 3rd-party companions in virtual property with Coinbase managing the transactions the place imaginable. Coinbase may even transform the primary WeWork member to make use of cryptocurrencies to pay for its membership.

MOSFETs are in stock with same-day shipping at Mouser Electronics from industry leading manufacturers. Mouser is an authorized distributor for many MOSFET manufacturers including Diodes Inc., Infineon, IXYS, Microchip, Nexperia, ON Semiconductor, STMicroelectronics, Texas. Mosfet Electronic Parts For Sale Mosfets are specialized field-effect transistors. MOSFET inputs, like the kind we sell, are comparatively substantial impedance, which may lead to stability difficulties. Their inputs are also relatively considerable impedance, which may lead to stability difficulties.

Coinbase not too long ago made headlines by becoming the first digital asset change to go public. the company is a global leader in the fintech business and the decision to pay WeWork in crypto will set the pace for different shoppers of WeWork to achieve this.

Related posts:

Contents

- 3 Bitpay v Coinbase Review

Coinbase and Bitpay are two established and popular cryptocurrency platforms, but there are a number of differences between them. Both platforms are outlined in detail below.

It is always best to perform extensive research before committing to any platform as fees can get out of hand. The main difference is that Coinbase is an exchange and Bitpay is a Bitcoin (BTC) payment processor.

Bitpay

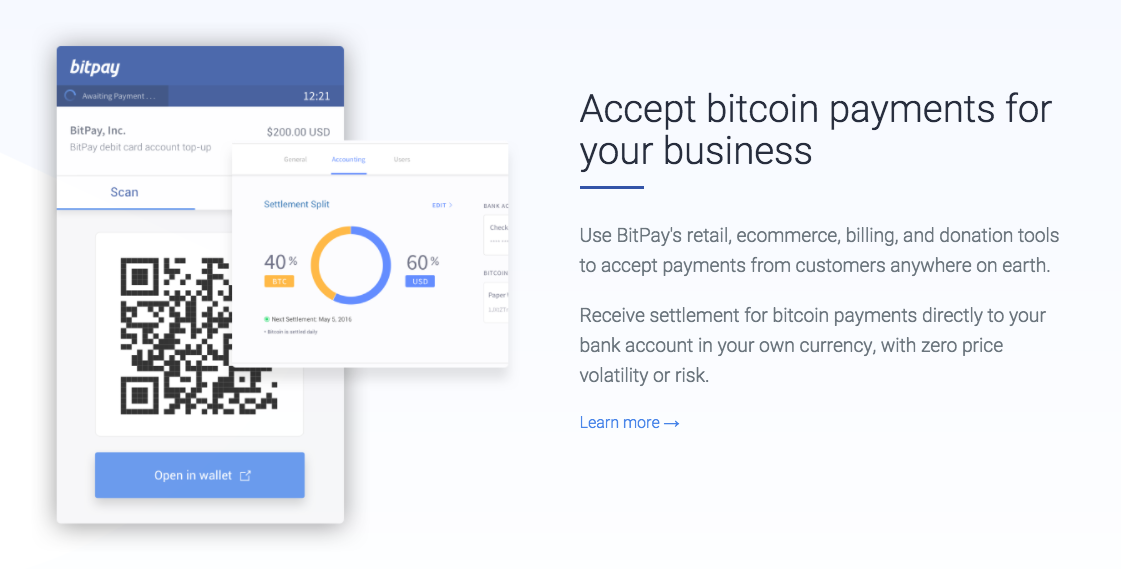

The aims of Bitpay are different from Coinbase. Bitpay is geared towards merchant payment processing as opposed to customers in that merchants can convert fiat currency directly if they want. Essentially, Coinbase is an exchange while Bitpay is a payment services provider which gives merchants the opportunity to accept Bitcoin as a means of payment.

In 2017 Bitpay processed more than $1 billion in BTC payments. Bitpay is currently adding support for multiple blockchains and digital currencies. Multi blockchain support is brand new and no other bitcoin payment provider has this. This will give more options to merchants as they can select the quickest and cheapest blockchain with the lowest mining fees.

They are also currently working on their platform to support transactions compatible with Segregated Witness, an upgrade to the BTC blockchain that makes it quicker and cheaper. Bitpay uses Two Factor Authentication and Google Authenticator and is quite secure.

Their aim is to reduce the price of bitcoin payments for merchants and make it as easy and smooth as possible. They have recently integrated Bitcoin Cash as well, giving merchants even more support.

If you are a merchant who wants to accept bitcoin as a form of payment, then Bitpay can definitely help. Bitpay offers guaranteed exchange rates, daily bank settlements, and flat rate pricing. They even offer an option to import Bitcoin sales to Quickbooks, an excel application useful for taxation and accounting.

Most Bitcoin merchants use Bitpay for the sale of digital content, to sell travel and tourism, and to accept donations and contributions to political campaigns. Bitpay's main competitors in the financial services space include GoCoin, Coinpayments and Bitcoin Payment Solutions (BIPS). Bitpay is currently the leader in the market.

Bitpay is the most affordable Bitcoin merchant payment processor around. Many of their options are zero transaction fees with zero hidden charges. This is unlike most cryptocurrency exchanges, which have heavy upfront charges and lots of hidden charges.

Cex.io comes to mind. What is great about Bitpay is that it eliminates price volatility during the buying process, as it guarantees the exchange rate during checkout.

And, of course, it allows for easy integration. Bitpay provides over 20 different shopping cart plugins to make it really simple. While most credit cards charge 3% per transaction,

Bitpay offers a flat 1% settlement charge for business, free up to $1000 with the starter package. In terms of receiving payments, merchants can choose eight major currencies or Bitcoin, and Bitpay supports invoicing in 40 languages.

It has never been hacked and is highly secure. Blue cross blue shield federal standard copay. Bitpay also offers a Bitcoin backed debit card. You can use it anywhere Visa is accepted, and ATM fees are currently $2 per withdrawal.

Coinbase

Coinbase is one of the largest exchanges in the world and has over 1 million active users. It is also one of the most popular and is based in the USA.

Coinbase is often called the 'Goldman Sachs' of the cryptocurrency sphere because it operates much like a bank in terms of how it works and how it is regulated. It is under close scrutiny by US authorities and you can rest assured that your funds are safe in Coinbase and that if it is somehow hacked, something which has not happened in its seven years of operation, then you will be refunded. They offer the best in terms of security.

But Coinbase is loathed by many cryptocurrency purists for a number of reasons. Coinbase has close ties with banks and regulatory authorities, locks accounts for no reason and have no small amount of negative customer feedback reviews.

The founders made some very questionable political maneuvers, such as promoting Bitcoin's main rival Ethereum, pledging support to the since failed Bitcoin classic and launching a number of ridiculous patents which go against the open source ethos.

Coinbase is really just a bank that allows you to buy and store Bitcoin. It even received an $11 million investment from Bank of Tokyo Mitsubishi and is backed by many heavy financial heavyweights. Coinbase makes it easy for users to convert a portion of their incoming payments to a fiat currency as well. Coinbase also offers users a super convenient wallet service, which means one can store incoming Bitcoin transfers in BTC on the same platform. The digital currency exchange also offers Bitcoin merchant services to users.

Further, Coinbase recently suffered from a credit card glitch. After the card networks updated their mcc codes, Coinbase users were overcharged for credit card purchases. Coinbase is in the process of refunding those affected. This wallet service makes it easier than ever for users to check out and process payments quicker.

Coinbase focuses on attracting new investors to the cryptocurrency market and it does a great job. It has an amazing interface and the buying and selling experience is incredibly smooth and intuitive, something that is lacking in most other cryptocurrency exchanges.

Coinbase offers an all in one platform for the buying and selling of cryptocurrencies and is really a one-stop shop. They have their own full trading exchange called the Global Digital Asset Exchange (GDAX). The GDAX is really the main Coinbase product and their primary point of focus.

GDAX trading fees are around .025%. Coinbase charges a 3.99% fee on credit card purchases and a 1.49% fee on bank transfer payments. Expect your Bitcoin to arrive five days after a bank transfer and instantly after a credit card payment.

SEPA transfers are free and Coinbase offers high buying limits and high liquidity. Not only this, but Coinbase verification is far quicker than the majority of other large cryptocurrency exchanges.

Bitpay Coinbase Work Together

Coinbase only supports 33 countries. You can also purchase Litecoin and Ethereum from Coinbase, as well as Bitcoin Cash.

Bitpay v Coinbase Review

Coinbase To Bitpay

Bitpay and Coinbase do different things. One of them is a cryptocurrency exchange where you can buy Bitcoin, Ethereum, Bitcoin Cash and Litecoin.

The other one is a Bitcoin merchant payment processing platform, which recently added support for Bitcoin Cash. Exchanges and payment processors are two different services entirely.

Coinbase not too long ago made headlines by becoming the first digital asset change to go public. the company is a global leader in the fintech business and the decision to pay WeWork in crypto will set the pace for different shoppers of WeWork to achieve this.

Related posts:

Contents

- 3 Bitpay v Coinbase Review

Coinbase and Bitpay are two established and popular cryptocurrency platforms, but there are a number of differences between them. Both platforms are outlined in detail below.

It is always best to perform extensive research before committing to any platform as fees can get out of hand. The main difference is that Coinbase is an exchange and Bitpay is a Bitcoin (BTC) payment processor.

Bitpay

The aims of Bitpay are different from Coinbase. Bitpay is geared towards merchant payment processing as opposed to customers in that merchants can convert fiat currency directly if they want. Essentially, Coinbase is an exchange while Bitpay is a payment services provider which gives merchants the opportunity to accept Bitcoin as a means of payment.

In 2017 Bitpay processed more than $1 billion in BTC payments. Bitpay is currently adding support for multiple blockchains and digital currencies. Multi blockchain support is brand new and no other bitcoin payment provider has this. This will give more options to merchants as they can select the quickest and cheapest blockchain with the lowest mining fees.

They are also currently working on their platform to support transactions compatible with Segregated Witness, an upgrade to the BTC blockchain that makes it quicker and cheaper. Bitpay uses Two Factor Authentication and Google Authenticator and is quite secure.

Their aim is to reduce the price of bitcoin payments for merchants and make it as easy and smooth as possible. They have recently integrated Bitcoin Cash as well, giving merchants even more support.

If you are a merchant who wants to accept bitcoin as a form of payment, then Bitpay can definitely help. Bitpay offers guaranteed exchange rates, daily bank settlements, and flat rate pricing. They even offer an option to import Bitcoin sales to Quickbooks, an excel application useful for taxation and accounting.

Most Bitcoin merchants use Bitpay for the sale of digital content, to sell travel and tourism, and to accept donations and contributions to political campaigns. Bitpay's main competitors in the financial services space include GoCoin, Coinpayments and Bitcoin Payment Solutions (BIPS). Bitpay is currently the leader in the market.

Bitpay is the most affordable Bitcoin merchant payment processor around. Many of their options are zero transaction fees with zero hidden charges. This is unlike most cryptocurrency exchanges, which have heavy upfront charges and lots of hidden charges.

Cex.io comes to mind. What is great about Bitpay is that it eliminates price volatility during the buying process, as it guarantees the exchange rate during checkout.

And, of course, it allows for easy integration. Bitpay provides over 20 different shopping cart plugins to make it really simple. While most credit cards charge 3% per transaction,

Bitpay offers a flat 1% settlement charge for business, free up to $1000 with the starter package. In terms of receiving payments, merchants can choose eight major currencies or Bitcoin, and Bitpay supports invoicing in 40 languages.

It has never been hacked and is highly secure. Blue cross blue shield federal standard copay. Bitpay also offers a Bitcoin backed debit card. You can use it anywhere Visa is accepted, and ATM fees are currently $2 per withdrawal.

Coinbase

Coinbase is one of the largest exchanges in the world and has over 1 million active users. It is also one of the most popular and is based in the USA.

Coinbase is often called the 'Goldman Sachs' of the cryptocurrency sphere because it operates much like a bank in terms of how it works and how it is regulated. It is under close scrutiny by US authorities and you can rest assured that your funds are safe in Coinbase and that if it is somehow hacked, something which has not happened in its seven years of operation, then you will be refunded. They offer the best in terms of security.

But Coinbase is loathed by many cryptocurrency purists for a number of reasons. Coinbase has close ties with banks and regulatory authorities, locks accounts for no reason and have no small amount of negative customer feedback reviews.

The founders made some very questionable political maneuvers, such as promoting Bitcoin's main rival Ethereum, pledging support to the since failed Bitcoin classic and launching a number of ridiculous patents which go against the open source ethos.

Coinbase is really just a bank that allows you to buy and store Bitcoin. It even received an $11 million investment from Bank of Tokyo Mitsubishi and is backed by many heavy financial heavyweights. Coinbase makes it easy for users to convert a portion of their incoming payments to a fiat currency as well. Coinbase also offers users a super convenient wallet service, which means one can store incoming Bitcoin transfers in BTC on the same platform. The digital currency exchange also offers Bitcoin merchant services to users.

Further, Coinbase recently suffered from a credit card glitch. After the card networks updated their mcc codes, Coinbase users were overcharged for credit card purchases. Coinbase is in the process of refunding those affected. This wallet service makes it easier than ever for users to check out and process payments quicker.

Coinbase focuses on attracting new investors to the cryptocurrency market and it does a great job. It has an amazing interface and the buying and selling experience is incredibly smooth and intuitive, something that is lacking in most other cryptocurrency exchanges.

Coinbase offers an all in one platform for the buying and selling of cryptocurrencies and is really a one-stop shop. They have their own full trading exchange called the Global Digital Asset Exchange (GDAX). The GDAX is really the main Coinbase product and their primary point of focus.

GDAX trading fees are around .025%. Coinbase charges a 3.99% fee on credit card purchases and a 1.49% fee on bank transfer payments. Expect your Bitcoin to arrive five days after a bank transfer and instantly after a credit card payment.

SEPA transfers are free and Coinbase offers high buying limits and high liquidity. Not only this, but Coinbase verification is far quicker than the majority of other large cryptocurrency exchanges.

Bitpay Coinbase Work Together

Coinbase only supports 33 countries. You can also purchase Litecoin and Ethereum from Coinbase, as well as Bitcoin Cash.

Bitpay v Coinbase Review

Coinbase To Bitpay

Bitpay and Coinbase do different things. One of them is a cryptocurrency exchange where you can buy Bitcoin, Ethereum, Bitcoin Cash and Litecoin.

The other one is a Bitcoin merchant payment processing platform, which recently added support for Bitcoin Cash. Exchanges and payment processors are two different services entirely.

However, Coinbase is adding many plugins for merchants at a fast rate and could go down this avenue with its superior resources, eating into Bitpay's market share. Coinbase is better known and better established in the digital currency realm, as it has more customers.

Transfer Bitcoin From Coinbase To Bitpay

It represents an entry point into the digital currency sphere for everyday consumers. Bitpay offers a similar service to merchants.